Background

My recent interactions with few of my friends and (seemingly conservative) clients regarding stocks, IPOs, short-term trading and investing provoked me to write this.

The people

I am doing business related to Personal Finance since 2017 and have personally interacted with at least 250 persons across age groups, genders, cities or villages and geographies.

Few of these people I had categorized as conservative in nature with reference to their knowledge about financial markets and hence their risk taking ability. But in recent past (after 2nd wave of CoVID-19 pandemic in India), two of such interactions were more than enough to pan out my thoughts (based on my experience into the financial markets and with various asset classes).

What was common?

Both of these friends are 38+ years of age and earning handsomely from their routine day jobs. In the past, I had suggested both of them to start investing regularly in mutual fund SIP for their long term financial goals. One of them was reluctant to start and was not responding to my reminders, also he told me he is heavily invested in real estates at his native place.

Now comes the common part that provoked me! After 2nd wave of pandemic when I got in touch with both of them, they asked me about my thoughts on short term trading through demat account. As a responsible personal finance expert, I had to give them the suitable advise – what it means to trade for short term in stock markets. Than they both told me that their SPOUSES are interested doing this!

Why? and How?

This is possibly a side effect of Pandemic on our life. Due to lockdowns, so many families saved tons of money which was spent regularly on outing, cloths, foods, etc (discretionary spending). After the lockdown lifted, family member with regular jobs again started going to office but their wives were at home and may wanted to earn something and also to remain active.

Second point to this was complete digitalization of demat account opening and operating it. Few clicks and your accounts are opened, which are even not charging any brokerages for delivery based trades. So easy opening with zero cost for cash segment has led to such spur in new demat account opening after 1st wave. Check image below:

With this total number of demat accounts in India are crossing 6 Crore mark as on 30th June 2021 with addition of 2+ Crore account from March 2020 to June 2021!!! (Source: ET)

Such spectacular retail participation in capital markets is hugely positive factor for broader markets over the long term as it leads to financial inclusiveness and asset diversification. This is evident from the data released by various Government agencies – financial assets (i.e. digital assets – stocks, mutual fund units, bonds, digital gold etc) are increased as compared to physical assets (real estate, physical gold etc). Historically, surge in number of demat accounts and participation of retail investors always starts in a Bull run (2000 Y2K/Dot Com, 2008 Lehman sub prime lending crisis etc) and in a developing countries like India such numbers are huge due to low base effect.

Liquidity

During the pandemic, globally all central banks started printing money to distribute to their citizens and to spend on emergency services, medical infrastructure, government expenses, etc. This was necessary to overcome the effects of lockdowns on tax collections for all governments. This infused very heavy liquidity into the banking systems and hence into the overall financial (digital) system. This is called liquidity.

Effect of this is mind blowing! As we know till now Covid-19 cases are not in control in developed nations (even though mortality rates are down significantly due to vaccination) as compared to India. Due to this, last declare numbers of inflation for USA is 6 odd percent while for India it is 5.3%! It means inflation is less in India for last quarter than in USA. Such dissimilarity in inflation numbers are observed for the first time in last 30 years. This is because Indian markets and economy is opened from the lockdowns for a while now and USA markets are still struggling with lockdowns and medical emergencies.

How is this positive sign?

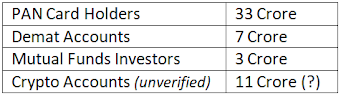

Total numbers of registered PAN, demat accounts opened, active mutual fund investors data is as below:

As we can observe from the table, even after years of existence, retail participation in country’s (well established) financial assets are at initial stages only. As more and more retail investors put more of their money into such digital assets, in the long term they will be benefited from the growth in value if they stay invested for longer time period and during turbulent times. On the other hand, foreign investors will eventually lose their dominant market share. If this happens, minor price fluctuations in our markets should not happen (though this is still distant future) due to local events in a foreign country (like interest rate change in US).

Of course, making truckload of money over the long term is absolutely possible if one has invested it wisely and staying put until the goal is achieved. For this it is essential to start investing at early age.

Another important aspect is from the fact that even we all are aware that crypto investment is unregulated, 11 Crores accounts are opened (this figure itself is impractical & controversial). Trading or investing your hard earned money in the crypto is not advisable to common retail investors.

Elephant in the room!

This rosy picture will turn black when investor is not able to control their emotions with their investments. The problem with one of our friend (mentioned above) is what one needs to keep in mind when we go shopping into financial markets! One should not rely on any tips for investments coming from news channel, newspaper, friend, neighbour, family member, social media (YouTube Twitter, Telegram are very much famous this days). For direct stocks investment one should do due diligence by themselves, study the business fundamentals, financial statements, management quality etc before investing their hard earned money and after investments are made tracking of their businesses quarter by quarter is also of prime importance. Yes, if you want to make tons of money from direct stocks investing this is part of the game.

GET RICH QUICK AND FREE! But this all seems bookish and useless to almost all of those 2 Crores demat account holders. They thought before entering into the stock markets that to make money invest Rs 10,000 today and in few days (or even within that day) it will become Rs 11,000, than close the trade and again invest this Rs 11,000 into another trade and so on. If this is how money made India would have become a 10 Trillion USD economy by now!

Here the problem is we think of making money quickly without any process or learning. So when the tide turns in the stock markets, markets become little bit more turbulent first timers may suffer a lot from such short term trades. There is a process / system (e.g. stop loss) to do such trading which is to be understood and followed with discipline to really make money by short term trading.

Same is true with mutual fund investments for long term. As human mind tends to follow the returns, we often end up investing our money in schemes that have given best returns in recent past. Technically, this is not accurate way of selecting schemes for investments. There are technical parameters, portfolio evaluations, asset allocation strategies are to be considered before making any investment decisions. Here also one should not invest based on tips!

Cost of Delay:

Check below table to understand how delaying our investment decisions by a few years cost us heavily. That’s why it is quite desirable to start the investment from our first income itself.

Look at above data, if we delay our investment just by 1 year we loose about Rs 20 Lakh in final maturity amount! Is this affordable? As per my experience, even if you don’t start this amount investing you will definitely spend this money mostly on unnecessary things.

So, How can I enjoy my life?

Of course, we earn money to enjoy our lives only. No meaning of saving money all our life for enjoyment by our nominees or legal heirs after we leave this beautiful planet!!

One have to make a small exercise of budgeting the expenses and plan for future financial goals, below is the rough example of doing this for a young person:

Household expenses (with EMI): 60%

Now the critical part is to stick to above allocation of your monthly income and make sure to invest this amount in suitable growth products (regulated). Also to keep increasing Monthly Investments amount on regular basis as per rise in your monthly incomes. This is not a solution for all of us but this can be a good starting point for the most. At least we can save 15-20% of our monthly income on regular basis.

Hope you liked this article and I request you to share this article to your friends and family members for helping them with their finances.

*Disclaimers: (1) Mutual fund investments are subject to market risks, read all scheme related documents carefully. (2) Past performance is no guarantee of future performance.

Realistic and Balanced advice.Strongly feel that I should save more via MF according to your advice whenever I check out my current MF valuation.